Table of Contents

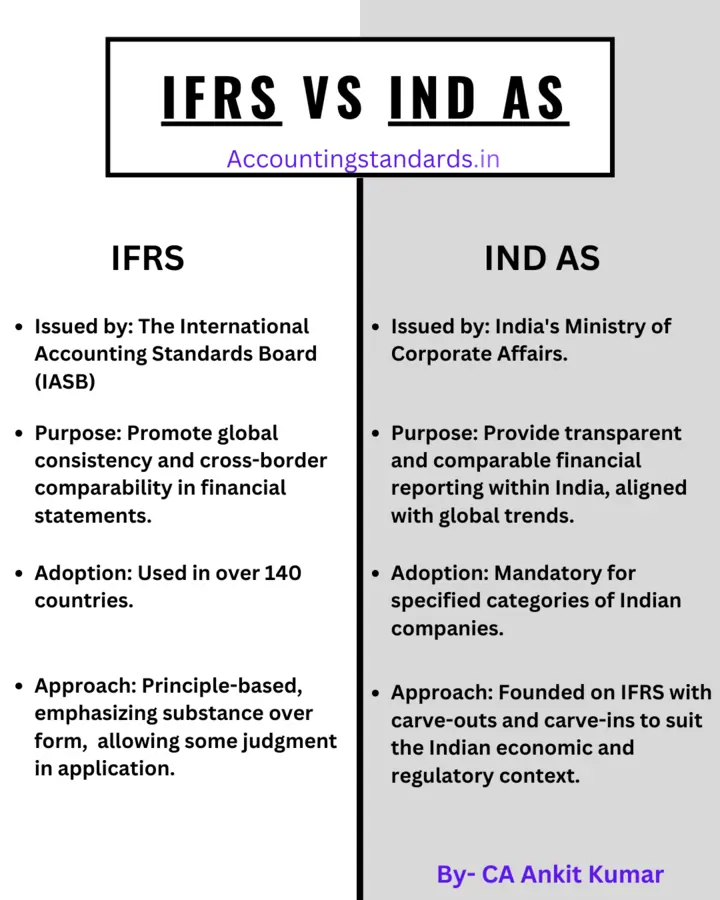

In the interconnected world of business, adhering to global standards for financial reporting is essential for transparency and comparability. For Indian companies, understanding the nuances between two critical sets of accounting standards is paramount: International Financial Reporting Standards (IFRS) and Indian Accounting Standards (Ind AS).

This post aims to provide a clear and comprehensive guide to these frameworks, empowering you to make informed decisions and produce accurate financial reporting.

What is IFRS:

The International Accounting Standards Board (IASB) issues International Financial Reporting Standards (IFRS) with the overarching aim of promoting global consistency and cross-border comparability in financial statements. Currently, over 140 countries utilize IFRS. A key characteristic of IFRS is its principle-based approach, prioritizing the economic substance of a transaction over its rigid legal form. This approach allows for a degree of professional judgment when applying the standards.

What is Ind AS:

India’s Ministry of Corporate Affairs issues Indian Accounting Standards (Ind AS). These standards draw heavily from IFRS while incorporating modifications tailored to India’s specific economic and regulatory landscape. Certain categories of Indian businesses, both listed and unlisted, are mandated to adhere to Ind AS. An ongoing convergence process aims to further align Ind AS with IFRS over time, gradually minimizing the differences between the two frameworks.

Similarities Between IFRS and Ind AS:

Despite their distinctions, IFRS and Ind AS share fundamental similarities. Both frameworks seek to deliver high-quality and transparent financial information that accurately reflects the underlying economic realities of business transactions.

Additionally, they prioritize ‘substance over form‘ emphasizing the genuine nature of a transaction rather than solely its legal structure.

Recent updates to Ind AS have resulted in even greater alignment with IFRS standards, reducing the overall divergence between the two.

Key Differences Between IFRS and Ind AS:

- Fair Value Measurement: IFRS (IFRS 13) offers comprehensive guidance on fair value determination, while Ind AS (Ind AS 113) permits more flexibility in valuation techniques.

- Financial Instruments: IFRS (IFRS 9) has broader principles for classifying, measuring, and impairing financial instruments. Ind AS (Ind AS 109) is closely aligned but retains a few exceptions, such as simpler hedge accounting provisions.

- Revenue Recognition: Both IFRS (IFRS 15) and Ind AS (Ind AS 115) use a five-step model. The emphasis on performance obligations leads to potential changes in the timing of revenue recognized.

- Business Combinations: In determining the acquirer, both IFRS (IFRS 3) and Ind AS (Ind AS 103) share a consistent basis. However, Ind AS allows the “pooling of interest” method for transactions under common control, affecting goodwill calculations.

- Leases: IFRS (IFRS 16) and Ind AS (Ind AS 116) require recognition of most leases on a lessee’s balance sheet, reducing off-balance-sheet financing.

Other Notable Areas of IFRS vs. Ind AS:

Beyond the key distinctions discussed, here are some further, more nuanced areas where IFRS and Ind AS may differ:

- Revaluation of Property, Plant & Equipment: Under Ind AS, companies have the option to revalue certain tangible assets to fair value. IFRS generally employs the cost model, with revaluation limited to specific circumstances.

- Provisions and Contingencies: IFRS generally has a stricter threshold for recognizing provisions, focusing on probable liabilities with quantifiable amounts. Ind AS may sometimes be more flexible in provisioning for potential obligations.

- Employee Benefits: The actuarial calculations and assumptions required for defined benefit plans can differ slightly between IFRS and Ind AS, resulting in potential variations in reported figures.

- Government Grants: IFRS and Ind AS can have variations in the timing and conditions for recognizing government grants as income.

- Related Party Disclosures: Ind AS mandates slightly more extensive disclosures related to transactions with related parties compared to the requirements under IFRS.

Importance of Understanding the Differences:

Recognizing and understanding the differences between IFRS and Ind AS is crucial for several reasons.

First and foremost, it ensures your company utilizes the correct accounting standards based on its size and reporting requirements, guaranteeing compliant financial reporting.

Adherence to globally recognized standards, be it IFRS or Ind AS, fosters investor confidence and enhances your company’s attractiveness within the investment landscape.

Furthermore, grasping the distinctions enables meaningful benchmarking and accurate comparisons between your company and its international peers.

Lastly, businesses transitioning from older Indian GAAP to Ind AS should be mindful of potential implementation costs and resource needs associated with this change

Case Study:

An Indian company (Company A), reporting under Ind AS, acquires a company reporting under IFRS (Company B). Determining the acquiring company would utilize similar criteria under both IFRS and Ind AS, with the transaction structure ultimately deciding. If the acquisition constitutes a ‘bargain purchase‘ IFRS mandates recognition of a gain on the income statement, while Ind AS may not explicitly require it.

Moreover, depending on the circumstances, Ind AS permits the “pooling of interests” method, potentially affecting the presentation of consolidated financial statements.

Conclusion:

IFRS and Ind AS are converging, making Indian financial reporting more aligned with global practices. However, the remaining differences demand attention for accurate reporting and informed decision-making by businesses and investors. Staying updated on both standards is crucial for maintaining credibility in global markets.

Do you have further questions about IFRS vs. Ind AS? Need support with implementation or navigating the differences? Leave a comment below or contact me for guidance.