Table of Contents

IND AS 107, also known as “Financial Instruments: Disclosures“, is an essential accounting standard that provides comprehensive guidelines for fair value measurements of financial instruments.

Does your company’s true value sometimes feel hidden by how certain investments are accounted for? IND AS 107 aims to change that. This standard puts focus on ‘fair value’ – what those assets could fetch on the open market – ensuring your financials paint a more accurate picture.

This article aims to explore the intricacies of IND AS 107, shedding light on its significance and implications for businesses. Additionally, we will cross-reference relevant IND AS standards to provide a holistic understanding of financial reporting.

Scope and Objective:

IND AS 107 applies to entities that prepare financial statements following the Indian Accounting Standards (IND AS). It is particularly relevant for entities dealing with financial instruments like- debt, equity, derivatives, and other investment instruments. The main objective of this standard is to enhance transparency and comparability in financial reporting. It achieves its objective by providing a standardized framework for disclosing information about the fair value of financial instruments.

Fair Value Measurement:

IND AS 107 emphasizes fair value as the principal measurement basis for financial instruments, encouraging entities to determine the value of their instruments based on market prices.

Fair value represents the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants.

Disclosure Objectives:

IND AS 107 aims to provide users of financial statements with detailed information about the methods and inputs used in fair value measurements.

It also emphasizes the importance of disclosing the significant judgments, assumptions, and uncertainties inherent in fair value measurements.

IND AS 107 doesn’t mean these valuations are wrong, but knowing the details on how they’re reached is key. This lets investors understand the riskiness of those assets far better than older accounting rules allowed.

Level of Fair Value Hierarchy:

One of the key aspects of IND AS 107 is categorising fair value measurements into different levels, known as the fair value hierarchy. This hierarchy provides users of financial statements with valuable insights into the reliability and inputs used in fair value measurements. Let’s discuss each level in detail:

Level 1: Quoted Prices in Active Markets

At the top of the fair value hierarchy is Level 1. This level represents fair value measurements based on quoted prices in active markets for identical instruments. These quoted prices are readily available in the market, allowing entities to determine the fair value of their financial instruments with a high degree of accuracy. Level 1 measurements provide transparency and objectivity, as they are based on observable market prices.

Level 2: Observable Inputs

Level 2 fair value measurements rely on observable inputs other than quoted prices in active markets. These inputs might include market data such as benchmark yields, interest rates, or other valuation models that utilize observable market data. While not as direct as Level 1 measurements, Level 2 still provides a reliable basis for fair value assessments. Entities using Level 2 inputs need to exercise judgment and expertise in selecting appropriate valuation techniques and inputs.

Level 3: Unobservable Inputs

At the bottom of the fair value hierarchy is Level 3, which encompasses fair value measurements based on unobservable inputs. These inputs are derived from the entity’s own assumptions, as they are not readily available from external markets. Level 3 measurements require significant judgment and involve complex valuation techniques, like- discounted cash flow models or option pricing models. Entities must disclose the key assumptions and factors used in Level 3 measurements, as they are subject to more uncertainty and potential variability.

Example Scenario:

Alpha Materials, a leading speciality chemicals company, invested in a start-up venture, Beta Innovations, several years ago. Beta Innovations is developing a revolutionary process that could be highly valuable to Alpha Materials’ industry. To determine the fair value of its investment for financial reporting purposes, Alpha Materials must utilize different levels of the Fair Value Hierarchy under IND AS 107.

- Level 1: Early on, Beta Innovations had publicly traded shares that Alpha Materials purchased. The fair value of this investment was easily determined based on the observable market price.

- Level 2: Later, Beta Innovations goes private, repurchasing all its public shares. Alpha Materials must now use comparable companies in adjacent sectors and apply appropriate adjustments to estimate the fair value of its investment in Beta Innovations.

- Level 3: The core intellectual property of Beta Innovations is a patent-pending technology. The value of this investment hinges on the patent’s approval. This requires a valuation model with highly subjective inputs, such as success probabilities and potential cash flows, placing it under Level 3.

How IND AS 107 Impacts Reporting:

- Not Just One Number: Alpha Materials likely discloses the range implied by the Level 2 and 3 valuations, as both are relevant given the circumstances.

- Sensitivity Analysis: Showing how the final value changes if key assumptions (patent approval odds, discount rates) shift, is likely required. This is the heart of Level 3 disclosure.

- Over Time: Each reporting period, those Level 3 inputs may get revised (new patent info emerges), impacting the fair value – the standard mandates transparency on this!

Significance of the Fair Value Hierarchy:

The fair value hierarchy holds great importance in understanding the reliability and inputs used in fair value measurements. It helps stakeholders assess the quality of information provided and the level of judgment involved in determining fair values. This hierarchy ensures comparability between different entities by providing a consistent framework for classifying fair value measurements.

Moreover, the fair value hierarchy assists regulators, auditors, and analysts in evaluating entities’ financial health and risk profile. It promotes transparency and enables stakeholders to make well-informed decisions based on disclosed fair-value information.

Disclosures Required:

- IND AS 107 mandates entities to disclose both quantitative and qualitative information about fair value measurements in their financial statements.

- In addition, entities should disclose the valuation techniques and key assumptions applied at each level for fair value measurements. This disclosure offers further clarity on the methods used to determine fair values and allows stakeholders to assess the reasonableness of these measurements.

- This includes information on the valuation techniques used, key inputs applied, sensitivity analysis, and changes in fair value measurements over time.

Cross-Referencing Relevant IND AS Standards:

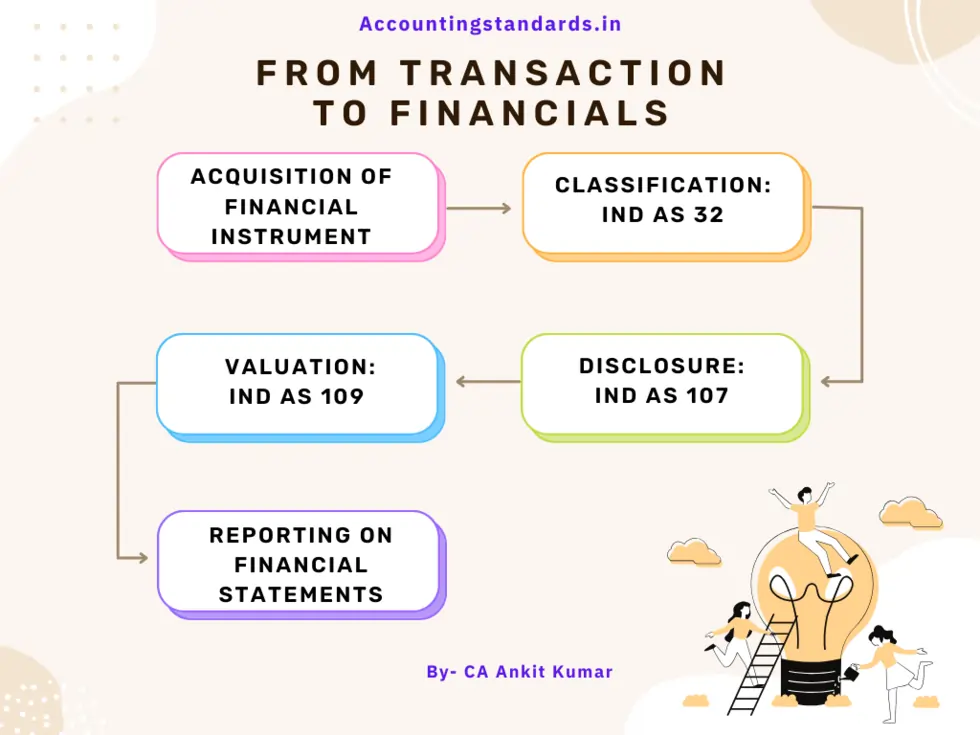

To gain a comprehensive understanding of financial reporting, it is beneficial to cross-reference IND AS 107 with other relevant IND AS standards:

- IND AS 32 and IND AS 109 guide recognizing, measuring, and presenting financial instruments, complementing the fair value measurement aspects outlined in IND AS 107.

- IND AS 112 focuses on measuring and disclosing the fair value of investments in associates and joint ventures.

- IND AS 109 and IND AS 113 can be cross-referenced to understand fair value disclosures related to financial instruments, investments in associates, and joint ventures, respectively.

Conclusion:

IND AS 107, “Financial Instruments: Disclosures”, is a crucial accounting standard that promotes transparency and comparability in financial reporting. By following this standard, entities can provide stakeholders with comprehensive information about the fair value of financial instruments, which enables them to better decision-making and risk management.

To gain a deeper understanding of financial reporting, it is essential to cross-reference IND AS 107 with relevant IND AS standards such as IND AS 32, IND AS 109, and IND AS 113. This holistic approach ensures compliance with all applicable accounting standards and enhances the quality and transparency of financial reporting.