Table of Contents

Have you ever seen a line item on a company’s financials like ‘Derivative Assets’ and wondered what it really represents? Could it be smart risk management or a cleverly obscured loss? IND AS 109, provides a comprehensive framework for the accounting treatment of financial instruments. This standard aims to ensure consistency and transparency in the recognition, measurement, and disclosure of financial instruments. Let’s dive deep into the key aspects of IND AS 109 to gain a better understanding.

Scope and Objective:

IND AS 109 applies to all entities that prepare financial statements under the Indian Accounting Standards. It covers a wide range of financial instruments, including financial assets, financial liabilities, and equity instruments. The standard applies to both initial recognition and subsequent measurement of these instruments, as well as the derecognition of financial assets and liabilities. The objective of IND AS 109 is to provide users of financial statements with useful and relevant information about an entity’s financial instruments.

What are Financial Instruments?

Before delving into the regulations themselves, it’s essential to understand the meaning of “financial instruments.” In the world of accounting, these refer to contracts that create a financial asset for one entity and a financial liability or equity instrument for another. Common examples include:

- Financial Assets:

- Cash and cash equivalents

- Investments in debt securities (bonds)

- Investments in equity securities (stocks)

- Loans and receivables

- Derivative contracts

- Financial Liabilities:

- Accounts payable

- Bank loans and other borrowings

- Bonds issued

- Derivative contracts

- Equity Instruments:

- Common stock

- Preferred stock

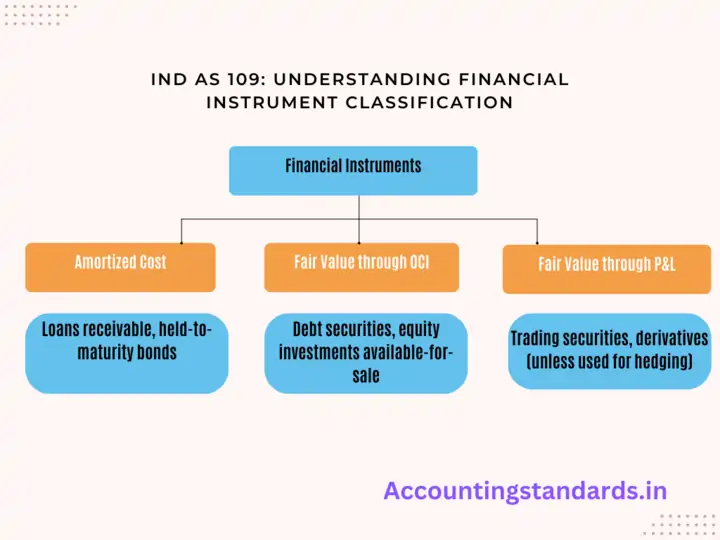

Classification and Measurement:

The classification depends on the entity’s business model for managing financial instruments and their contractual cash flow characteristics. This classification is made according to the guidelines of Ind As 32. Ind As 32 provides specific guidelines on the presentation and disclosure of financial instruments in the financial statements. Financial instruments are subsequently measured at either amortized cost, fair value through other comprehensive income (OCI), or fair value through profit or loss.

Amortized Cost:

Amortized cost is a measurement category for FIs. It applies to financial assets that are held within a business model whose objective is to hold assets to collect contractual cash flows and where those cash flows represent solely payments of principal and interest.

Financial assets measured at amortized cost are initially recognized at fair value and subsequently measured at amortized cost using the effective interest method. The effective interest rate is the rate that discounts estimated future cash flows over the expected life of the financial asset or liability.

Fair Value through Other Comprehensive Income (OCI):

Fair value through OCI is another measurement category under IND AS 109. It applies to debt instruments that are held within a business model whose objective is achieved by both collecting contractual cash flows and selling financial assets.

Financial assets measured at fair value through OCI are initially recognized at fair value, and changes in fair value are recognized in other comprehensive income. Interest revenue, impairment losses, and foreign exchange gains or losses are recognized in profit or loss.

However, when the instrument is derecognized or impaired, the accumulated gains or losses in OCI are reclassified to profit or loss.

Fair Value through Profit or Loss:

The fair value through profit or loss category applies to financial assets that are held for trading purposes or those designated upon initial recognition.

Financial assets measured at fair value through profit or loss are initially recognized at fair value, and subsequent changes in fair value are recognized in profit or loss. This category provides more flexibility for entities to recognize changes in fair value immediately and reflects the trading intent or designation made by the entity.

| Characteristic | Amortized Cost | FVTOCI | FVTPL |

|---|---|---|---|

| Business Model Objective | Held to collect contractual cash flows | Held for collecting cash flows AND potential sale | Held for trading / designated at initial recognition |

| Examples | Loans, basic bonds, accounts receivable | Investments in debt securities | Stocks in a trading portfolio, derivatives |

| Initial Measurement | Fair value + transaction costs | Fair value | Fair value |

| Subsequent Measurement | Amortized cost using effective interest rate | Fair value, gains/losses in OCI | Fair value, gains/losses in profit or loss |

| Impairment | Yes | Yes | No |

| Reclassification | Allowed if business model changes | Allowed if business model changes | Generally not allowed |

Criteria for Initial Recognition:

According to IND AS 109, a financial instrument is recognized initially when an entity becomes a party to the contractual provisions of the instrument. This occurs when the entity has both the contractual rights to receive cash flows and the contractual obligation to deliver cash flows or another financial instrument to another party.

Transaction Costs:

In addition to measuring the fair value, an entity includes any directly attributable transaction costs in the initial carrying amount of the financial instrument. These costs may include brokerage fees, commissions, and legal fees incurred in acquiring or issuing the instrument.

However, any transaction costs associated with financial instruments classified as at fair value through profit or loss are expensed immediately. If you want to know about the recognition of revenue you can read revenue from contracts with customers.

Fair Value Measurement:

Fair value plays a significant role in Accounting, It refers to the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants.

The standard guides how to measure fair value for these instruments, including the use of observable market inputs or valuation techniques when market data is not readily available. If you want to know more about the measurement of fair value, you can refer to Ind As 113 fair value measurements.

Examples:

Here are some examples demonstrating how IND AS 109 is applied using the different measurement methods, focusing on the accounting treatment:

Example 1: Amortized Cost

- Scenario: A company buys a 5-year bond for ₹100,000 with an 8% interest rate.

- Treatment:

- Record bond at ₹100,000 initially.

- Interest revenue is calculated using the effective interest rate, adjusting the bond’s value over time.

- Impairment losses are recognized if the bond’s value is unlikely to be fully recovered.

Example 2: Fair Value through OCI (FVOCI)

- Scenario: A company buys a debt security for ₹500,000 to collect cash flows and possibly sell later.

- Treatment:

- Record security at ₹500,000 initially.

- Changes in fair value go to Other Comprehensive Income (OCI), not directly to profit or loss.

- Gains/losses from OCI move to profit or loss upon sale or impairment of the security.

Example 3: Fair Value through Profit or Loss (FVPL)

- Scenario: A company buys shares for short-term trading purposes (cost: ₹200,000).

- Treatment:

- Record shares at ₹200,000 initially.

- All changes in the shares’ fair value (both gains and losses) are immediately recognized in profit or loss.

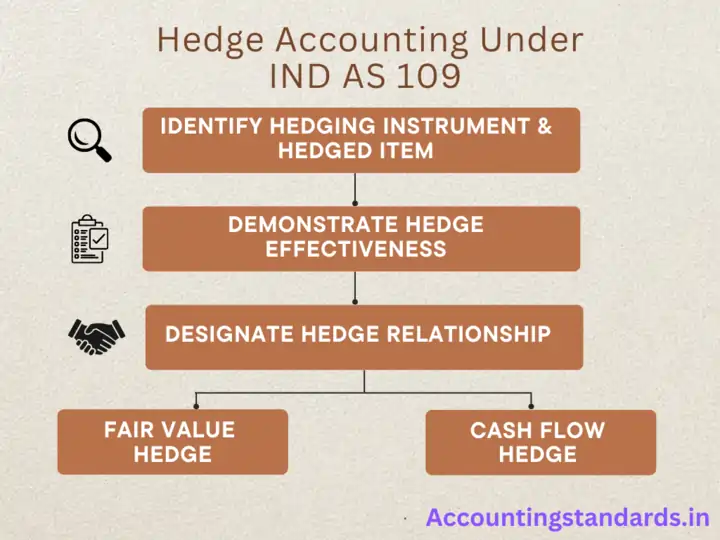

Hedge Accounting:

Hedge accounting is a specialized accounting technique that allows businesses to offset the risks associated with certain financial instruments or transactions.

It involves the identification and designation of specific hedging relationships, which aim to reduce the volatility of financial statements caused by fluctuations in market prices or exchange rates.

Hedge accounting enables businesses to match the recognition of gains or losses on the hedging instrument and the hedged item, resulting in more accurate and meaningful financial reporting.

The Importance of Hedge Accounting:

Hedge accounting plays a crucial role in financial management for several reasons:-

- It provides a more accurate depiction of a company’s financial position by giving the effects of hedging activities on the financial statements.

- Hedge accounting helps businesses make informed decisions by providing reliable information on the impact of hedging activities on profitability and cash flows.

- Complying with hedge accounting standards enhances transparency and credibility, fostering trust and confidence among stakeholders.

Guidelines for Hedge Accounting under Ind AS 109:

Ind AS 109 provides specific guidelines for hedge accounting to ensure consistency and comparability across entities. there are some key factors of hedging:

Hedging Instruments and Hedged Items:

Entities have to clearly identify the hedging instruments (Like- derivatives, options, or forward contracts) and the hedged items (Like- assets, liabilities, or forecasted transactions) in their hedging relationships. The relationship between the hedging instrument and the hedged item must be highly effective in offsetting the risk being hedged.

Hedge Effectiveness:

To qualify for hedge accounting, businesses must demonstrate the effectiveness of the hedge in offsetting the risk being hedged. The effectiveness is measured by assessing the changes in fair value or cash flows of the hedging instrument and the hedged item.

Documentation and Documentation:

Businesses are required to maintain proper documentation that outlines the hedging objectives, strategies, and risk management policies. This documentation serves as evidence of the entity’s intention to hedge and provides support for hedge accounting treatment.

Hedge Accounting Methods:

Ind AS 109 allows for two main methods of hedge accounting: fair value hedge accounting and cash flow hedge accounting.

- Fair value hedge accounting is used when the hedged item exposes the entity to changes in fair value.

- Cash flow hedge accounting is used when the hedged item affects future cash flows.

Ongoing Assessment and Reporting:

Entities must regularly assess the effectiveness of their hedging relationships and update the accounting treatment accordingly. Any ineffectiveness in the hedge is recognized in the income statement, ensuring transparent reporting of hedging activities.

Example of Hedge Accounting

- Scenario: A Company has US dollar sales, and buys USD/INR forward contracts to reduce currency risk.

- Treatment:

- Gains/losses on the forward contracts (hedging instrument) directly affect profit or loss.

- The actual USD sales conversion (hedged item) is adjusted to mirror the gain/loss on the contracts, smoothing income volatility

Reclassification and Reclassification Adjustments:

If underlying business models or instrument qualities undergo substantial changes, financial instruments’ classification may require reclassification.

Reclassification adjustments are made to reflect the appropriate measurement category in subsequent periods. These adjustments ensure consistency and accuracy in the measurement and reporting of financial instruments.

Impairment Assessment:

In addition to subsequent measurements, IND AS 109 requires entities to assess the impairment of financial assets. The impairment assessment involves evaluating the credit risk and estimating the expected credit losses associated with financial assets.

This assessment ensures that the carrying amount of the financial asset is adjusted appropriately to reflect any credit losses.

As per RBI guidelines, banks are now required to apply Ind-As and it makes a substantial impact on the banking industry in India.

Example of Impairment Assessment:

- Scenario: A Company has ₹1,000,000 in loans receivable. Borrowers’ financial health deteriorates.

- Treatment:

- The expected credit loss (ECL) model is used to assess if the loans may not be fully repaid.

- An impairment loss, if deemed necessary, is recognized in profit or loss, and the loans’ carrying value on the balance sheet decreases.

Disclosures:

Entities are required to disclose relevant information about the initial recognition of financial instruments. This includes details about the fair value measurement techniques used, the significant assumptions made, and the nature and extent of any valuation processes applied. The objective of these disclosures is to provide users of financial statements with a clear understanding of the initial recognition process and the associated risks and uncertainties.

Conclusion:

The categorization of financial instruments into amortized cost, fair value through OCI, and fair value through profit or loss is a fundamental aspect of IND AS 109. Each category has its specific criteria and accounting treatment, which entities need to carefully apply. By understanding the characteristics and requirements of each measurement category, entities can ensure accurate and reliable financial reporting. Adequate disclosures also enhance transparency and enable users of financial statements to make informed decisions.

FAQ:

How does this standard classify financial assets?

Ind AS 109 classifies financial assets into three categories: financial assets at amortized cost, financial assets at fair value through other comprehensive income, and financial assets at fair value through profit or loss.

How are financial liabilities measured under this Ind AS?

Financial liabilities, except for those designated at fair value through profit or loss, are generally measured at amortized cost using the effective interest rate method.

Does Ind AS 109 provide guidance on the impairment of financial assets?

Yes, this standard provides guidance on the recognition and measurement of impairment losses for financial assets, including the use of expected credit loss (ECL) models.

How does Ind AS 109 handle the derecognition of financial assets and liabilities?

Ind AS 109 provides criteria for the derecognition of financial assets and liabilities, including when the contractual rights to the cash flows expire or are transferred, and when substantial risks and rewards of ownership are transferred.