Table of Contents

Fair value measurement is a crucial part of financial reporting, giving users information about the worth of assets, liabilities, and equity instruments. IND AS 113 provides a framework for this process. Let’s explore its principles, significance, and practical uses to understand how it works.

Understanding IND AS 113:

IND AS 113 establishes a comprehensive framework for measuring fair value and guides how entities should determine the fair value of assets, liabilities, and equity instruments. The standard aims to enhance consistency and comparability in fair value measurements across different entities and industries.

Key Concepts:

Fair Value:

In the simplest terms, fair value is the price you could reasonably expect to get if you sold an asset or the price you’d pay to hand off a liability, in a normal market transaction today. Here’s the key—it’s not about what the asset or liability is worth to you specifically, but rather what the broader market sees as its value.

Market Participants:

Market participants are hypothetical buyers and sellers with reasonable knowledge of the asset or liability being valued and are willing to transact in the market.

Highest and Best Use:

Imagine how the asset is currently used, but also consider other profitable potential uses to maximize fair value assessment.

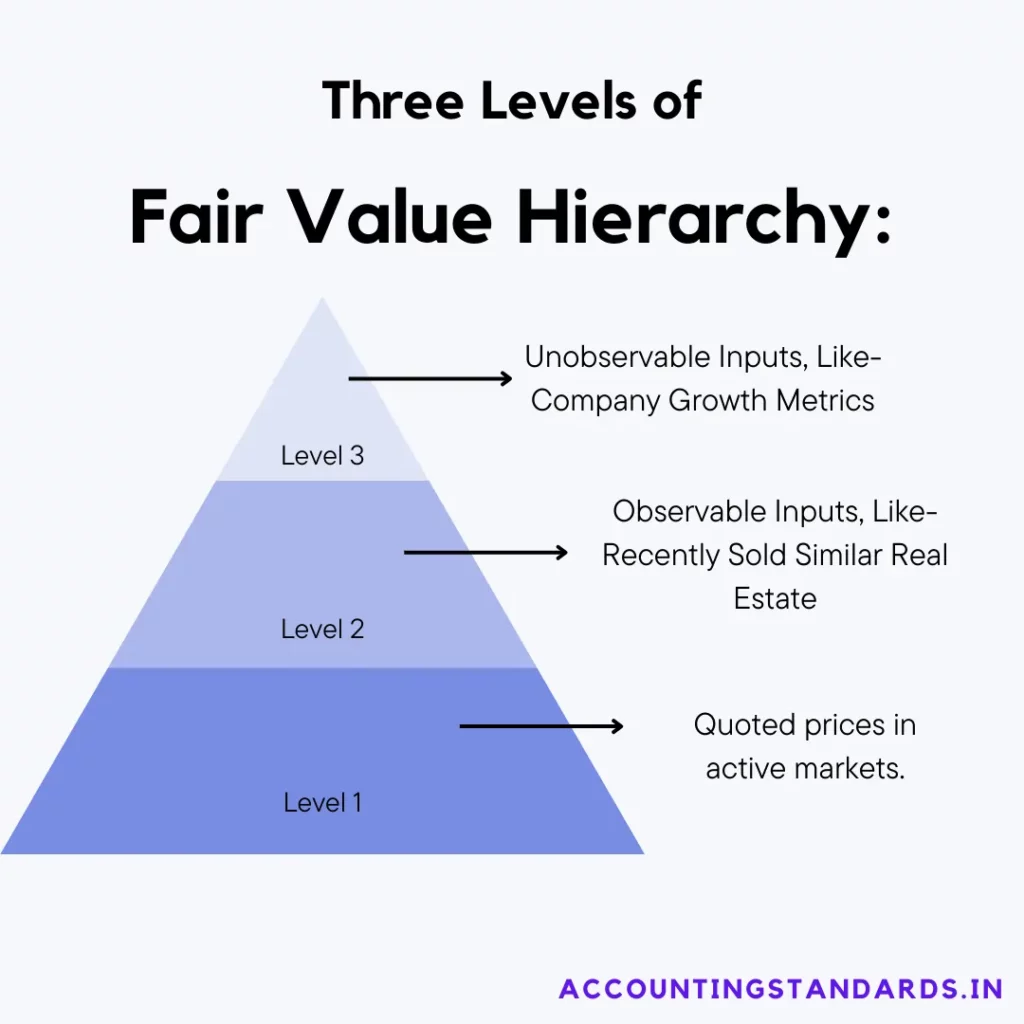

Fair Value Hierarchy:

IND AS 113 ranks data inputs that help determine fair value. Level 1 (best) is directly quoted market prices. Level 3 (least reliable) uses significant internal assumptions.

- Level 1: inputs are quoted prices in active markets,

- Level 2: inputs are observable market data, and

- Level 3: inputs are unobservable inputs requiring significant judgment.

you can read more about level of Fair Value Hierarchy here.

Practical Implications:

Valuation Techniques:

The standard guides on selecting appropriate valuation techniques to measure fair value. These techniques may include market-based approaches (Like- quoted prices in active markets), income-based approaches (for instance- discounted cash flow analysis), and cost-based approaches (For example- replacement cost or reproduction cost).

Inputs and Assumptions:

Entities should carefully consider the inputs and assumptions used in fair value measurements. Inputs should be based on observable market data whenever possible, and unobservable inputs should be supported by reasonable and supportable assumptions. These assumptions are like-

- Valuation Techniques:- Depending on the asset/liability, standards-compliant fair value determination may use market comparisons, income analysis, or cost-based methods.

- Inputs and Assumptions:- Observable market data is best, but even estimations used under the standard must be justifiable and well-documented.

Examples:

Scenario 1.

A company wants to sell its older delivery vehicle. They see similar used vehicles for sale online, with prices varying between dealerships and private sellers.

now as per IND AS 113 When they figure out the “vehicle” of their vehicle to record in their financial records, they can’t just pick a price they want or base it on how useful the car was to them. IND AS 113 says they need to look at the bigger picture of the used car market. Here’s how:-

- Comparable Sales: What are other cars like theirs (same condition, mileage) selling for? This gives them a good starting point.

- Market Trends: Is the used car market hot right now, or are prices dropping? These overall trends will change what price they can reasonably expect.

- Vehicle Condition: Does their car have problems, or has it been super well-maintained? Being honest about its condition helps them put a price tag on it compared to those other used cars.

Scenario 2.

A company owns an empty piece of land in an area that’s starting to grow. Right now, the simplest option is to rent it out as a parking lot, getting some money. However, IND AS 113 makes them think big about its value.

So as per guidence of Ind As When figuring out the ‘fair value’ of the land for their financial records, they can’t just focus on the small profits from parking. Here’s why IND AS 113 wants them to consider its potential:-

- Future Development: Is the city adding buildings and roads nearby? If the area might become more valuable later, that ‘future state’ affects what the land could fetch on the market even today.

- Possible Zoning Changes: Are there rumours of rules changing for what can be built there?

Benefits and Challenges:

The adoption of IND AS 113 brings several benefits to financial reporting, including increased transparency, comparability, and reliability of fair value measurements. It provides more information to stakeholders to make decisions based on the valuation of assets, liabilities, and equity instruments.

However, the application of fair value measurement can also have some challenges, Like- the subjectivity involved in determining unobservable inputs, the complexity of certain valuation techniques, and the need for professional judgment to ensure the accuracy and appropriateness of fair value measurements.

Impact on Financial Reporting:

Fair value measurement has a significant impact on financial reporting, as it provides relevant and up-to-date information about an entity’s assets, liabilities, and financial instruments. By reflecting the market value of these items, financial statements become more informative, aiding investors, analysts, and other stakeholders in making informed decisions.

Furthermore, fair value measurements are utilized in various accounting standards, such as for investment properties, financial instruments, and business combinations. IND AS 113 provides a consistent framework for measuring fair value across different accounting contexts, ensuring comparability and reliability in financial reporting.

Disclosures:

IND AS 113 requires entities to provide extensive disclosures about fair value measurements. These disclosures include information about the valuation techniques used, the significant inputs and assumptions, and the sensitivity of fair value measurements to changes in those inputs.

Conclusion:

IND AS 113 plays a crucial role in guiding entities in the measurement of fair value, enabling them to provide relevant and reliable information to users of financial statements. By adhering to the principles and concepts outlined in the standard, entities can enhance the transparency and comparability of their fair value measurements.

Fair value measurement under IND AS 113 promotes the consistent and robust assessment of assets, liabilities, and equity instruments, empowering stakeholders to evaluate an entity’s financial position, make informed investment decisions, and assess risk exposures.