Table of Contents

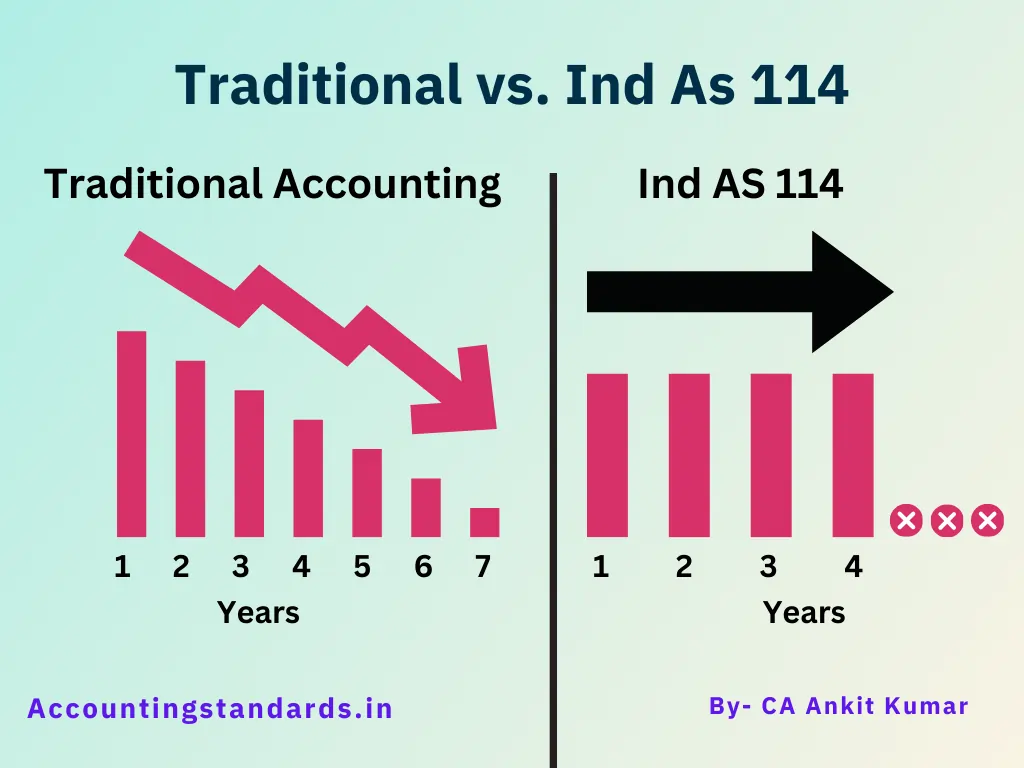

Investors often seek out utilities for their seemingly steady returns, however understanding these companies’ true financial health requires looking beyond simple profit reports. That’s where Ind AS 114 comes in – a complex set of rules dictating how regulated entities account for costs.

Ind AS 114, also known as “Regulatory Deferral Accounts“, is a standard issued by the Accounting Standards Board (ASB) of ICAI that guides the accounting treatment for regulatory deferral account balances. In this article, we will dive deep into the key aspects of this standard, including its scope, recognition, measurement, and disclosure requirements.

Scope:

Ind AS 114 applies to entities that are subject to the level of regulation, such as utility companies, where regulators establish the prices or rates that the entity can charge for their goods or services. This standard addresses the accounting treatment of temporary differences arising from the regulatory deferral account balances.

While Ind AS 114 focuses on corporate reporting, regulators themselves utilize these standardized financials. When a utility seeks a rate increase or proposes expanding into a new market, justification of financial need relies heavily on data produced in compliance with this standard. Thus, Ind AS 114 impacts even those who never pore over financial statements directly.

Recognition and Measurement:

Under Ind AS 114, regulatory deferral account balances are recognized when they meet the definition of assets or liabilities as per the Framework for the Preparation and Presentation of Financial Statements. These balances represent future economic benefits or obligations that arise due to the rate-regulated activities.

Measurement of these unique, regulator-influenced items depends on their nature. Assets and liabilities in these accounts are measured at the amount expected to be realized or settled, considering the regulatory decisions and their impact on the entity’s financial position.

Adjustments in these regulated asset/liability categories are recognized in the statement of profit and loss. These adjustments reflect changes in the expected future cash flows due to revised revenue forecasts allowed by the regulator, unexpected cost shifts, etc.

Case Study:

Example 1:

A telecommunications company TechCom, operates in a highly regulated industry. As part of its operations, TechCom incurs substantial costs for obtaining necessary licenses and permits from regulatory authorities. These costs, known as regulatory deferral accounts, play a crucial role in ensuring accurate financial reporting and compliance with Ind AS 114.

For instance:

TechCom recently invested a significant amount in securing a spectrum license to expand its network coverage. The cost of acquiring this license is substantial and will be recognized as an intangible asset on the balance sheet.

However, under Ind AS 114, TechCom will amortize the cost over the license’s expected useful life, matching the revenue generated from the increased network coverage.

This approach ensures that TechCom accurately reflects the costs associated with regulatory compliance in its financial statements. By spreading the costs over the expected revenue-generating period, TechCom presents a clear and transparent picture of its financial performance to stakeholders, including investors, regulators, and the general public.

Example 2:

Imagine a power company suddenly needs whole new grid years ahead of schedule. Normally, those expensive upgrades would get accounted for slowly on their books. But, Ind AS 114 often forces companies to recognize that huge cost much faster. Why does this matter? Two things:

- Regulators might let them raise customer prices sooner to help pay for it.

- It could limit their ability to get government help (subsidies) since they might seem less financially in need.

Disclosure Requirements:

Ind AS 114 places significant emphasis on disclosure to ensure transparency and provide users of financial statements with relevant information. Entities are required to disclose information about the nature and extent of their rate-regulated activities, including the recognition and measurement of regulatory deferral account balances.

The disclosure should also provide details about the accounting policies adopted, the regulatory framework under which the entity operates, and any significant judgments or estimates made in applying the requirements of Ind AS 114.

Benefits of Ind AS 114:

Ind AS 114 brings several benefits to entities and their stakeholders.

Firstly, it enhances the transparency and comparability of financial statements by providing a consistent framework for accounting and reporting of regulatory deferral account balances. This allows investors and other users of financial statements to better understand the financial effects of rate regulation on the entity’s operations.

Secondly, Ind AS 114 facilitates the decision-making process for management by providing relevant and reliable information on the financial impacts of regulatory activities. It enables entities to assess the financial implications of rate regulation and make informed strategic decisions accordingly.

Conclusion:

Ind AS 114 plays a vital role in ensuring the accurate recognition, measurement, and disclosure of regulatory deferral account balances. By following the guidelines outlined in this standard, entities can effectively communicate the financial effects of rate regulation to their stakeholders, fostering transparency and informed decision-making.

It is crucial for entities subject to rate regulation to understand and apply the provisions of Ind AS 114 diligently to comply with accounting standards and provide reliable financial information.