Table of Contents

Did you know inconsistent revenue recognition practices were identified in over 50% of audited Indian companies before the implementation of IND AS 115? This new standard brings much-needed consistency and reliability to how businesses report their earnings. Let’s take a closer look at IND AS 115 and its key components.

Scope and Objective:

IND AS 115 applies to most contracts with customers, providing rules for when and how much revenue a company can record. The main objective of the standard is to accurately depict the transfer of promised goods or services to customers and reflect the consideration the company expects to receive.

IND AS 115 does not apply to leases, insurance contracts, financial instruments, and certain non-monetary exchanges between entities in the same line of business.

Accounting under Ind As 115:

IND AS 115 simplifies revenue recognition by providing a standardized approach for companies to follow when recognizing revenue from contracts with customers. By following the five-step model, companies can ensure transparent and consistent reporting, allowing stakeholders to understand a company’s financial performance better. Adhering to IND AS 115 is essential for maintaining integrity and comparability in revenue recognition practices.

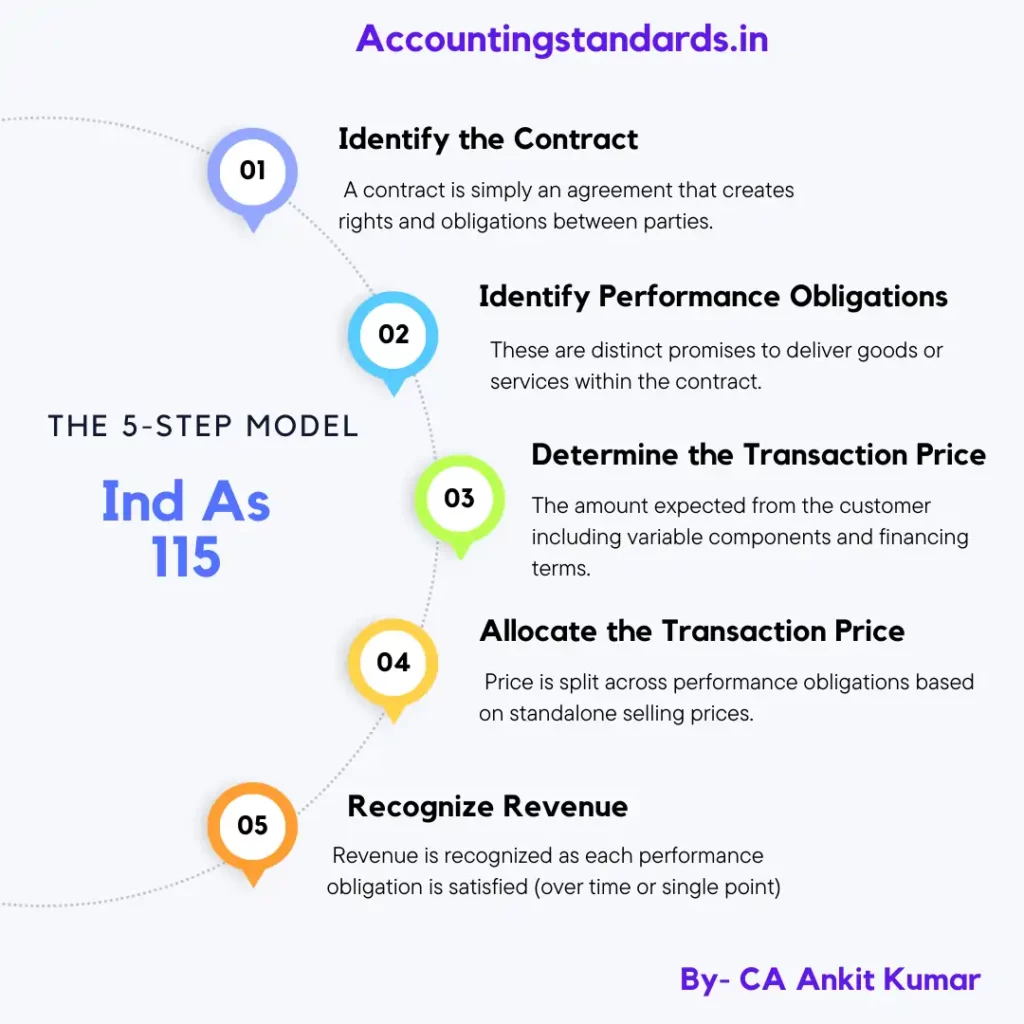

Ind As 115 5-Step Model:

IND AS 115 revolutionizes the process of revenue recognition with its 5-step model, bringing much-needed standardization and clarity. Let’s break down each step with the help of a relevant example.

Example Situation: A company sells a computer bundle that includes a desktop, monitor, and a one-year software subscription. The standalone price of the desktop is ₹40,000, the monitor is ₹15,000, and the subscription is ₹5000. The bundle price is ₹55,000. We will discuss treatment in each step-

Step 1: Identify the Contract:

The first step involves determining whether a contract exists with a customer. A contract is simply an agreement that creates rights and obligations between parties.

In our case, A customer has agreed to purchase the computer bundle from the company.

Step 2: Identify the Performance Obligations:

Once a contract is identified, the next step is to identify the performance obligations within the contract. Performance obligations are promises made by the company to transfer distinct goods or services to the customer.

In our situation, All performance obligations are-

- Desktop: Providing the physical desktop computer.

- Monitor: Delivering the monitor

- Software Subscription: Granting the customer access to the software for one year.

Step 3: Determine the Transaction Price:

The transaction price is the amount of consideration the company expects to receive in exchange for transferring the promised goods or services to the customer. It may include variable amounts, non-cash considerations, or even financing components.

In our case, The agreed-upon bundle price of ₹55,000 is the transaction price.

Step 4: Allocate the Transaction Price:

In this step, the transaction price is allocated to each distinct performance obligation within the contract. The allocation is based on the relative standalone selling prices of the goods or services involved.

In our case: we allocate transaction price as below-

Total Standalone Price: ₹40,000 (desktop) + ₹15,000 (monitor) + ₹5,000 (subscription) = ₹60,000

| Description | Standalone Price | Calculations | Proportion |

|---|---|---|---|

| Desktop | ₹40,000 | ₹40,000 / ₹60,000 | 66.67% |

| Monitor | ₹15,000 | ₹15,000 / ₹60,000 | 25% |

| Subscription | ₹5,000 | ₹5,000 / ₹60,000 | 8.33% |

| Description | Standalone Price | Proportion | Bundle Allocation |

|---|---|---|---|

| Desktop | ₹40,000 | 66.67% | ₹36,668.50 |

| Monitor | ₹15,000 | 25% | ₹13,750 |

| Subscription | ₹5,000 | 8.33% | ₹4,581.50 |

Step 5: Recognize Revenue:

Revenue is recognized when the company satisfies a performance obligation by transferring control of the promised goods or services to the customer. Control can be transferred over time or at a specific point in time, depending on the nature of the obligation.

As per our situation:-

- Desktop & Monitor: Revenue is recognized at the point in time when those items are delivered to the customer.

- Subscription: Revenue is recognized over the one-year subscription period, likely every month (₹4,581.50 / 12 months = approximately ₹381.80 per month).

Contract Modifications:

If a contract undergoes modifications, the company must assess-

- Whether the modifications create new performance obligations or

- Changes to existing ones.

Adjustments to the transaction price are also necessary to reflect the changes in contractual terms.

Example: Let’s say the very next day before the desktop and monitor have been shipped, the customer calls and says, “I’ve decided I don’t want the monitor. Can I still get the desktop and subscription?” The company agrees and offers a revised bundle price of ₹48,000.

Analysis of whether it is a modification or separate contract: Likely treated as a modification of the original agreement since some items are the same and it occurred before any part of the contract was fully completed.

Now, The transaction price drops (₹55,000 to ₹48,000). While standalone prices haven’t changed, the bundle structure now impacts pricing Allocation.

Now suppose that the customer contacts the company wishing to add a keyboard to their setup. The keyboard’s standalone selling price is ₹2,000.

- If the keyboard is sold to them at ₹2,000, there’s potentially zero modification impact – it’s a new transaction.

- But, if they offer it for ₹1,500 to reward customer loyalty, this implies linked pricing. Revenue on the original bundle may need retrospective adjustment depending on how that ₹500 is allocated across existing performance obligations.

Variable Consideration:

Variable considerations, such as discounts, rebates, or performance bonuses, should be estimated and included in the transaction price if it is probable that a significant reversal of revenue will not occur.

Time Value of Money:

When a contract includes a significant financing component, the transaction price should be adjusted to reflect the time value of money using an appropriate discount rate.

Disclosures:

IND AS 115 requires extensive disclosures to provide users of financial statements with a better understanding of the nature, amount, timing, and uncertainty of revenue and cash flows from contracts with customers. The disclosures include qualitative and quantitative information about revenue recognition policies, contract balances, performance obligations, and significant judgments and estimates.

Transition and Implementation:

Companies transitioning to IND AS 115 should carefully plan and execute the adoption process. This involves evaluating existing contracts, identifying differences between previous accounting practices and the new standard, and making the necessary adjustments retrospectively or using a modified approach.

Transitioning from the old AS to IND AS 115 requires careful planning, assessment, and execution. Companies can successfully navigate the transition process by conducting a comprehensive impact assessment, identifying gaps, developing an implementation plan, updating policies, providing training, performing testing, and ensuring proper disclosure.

The adoption of IND AS 115 will result in improved transparency and comparability in revenue recognition practices, enhancing the quality and reliability of financial reporting.

Conclusion:

Accounting under “IND AS 115:Revenue from Contracts with Customers” brings a more robust and principles-based approach to revenue recognition. The five-step model provides a structured framework for companies to recognize revenue from customer contracts. Businesses must understand and implement the standard accurately, ensuring appropriate disclosures and compliance with the requirements of The Ministry of Corporate Affairs (MCA). Adhering to IND AS 115 will enhance transparency, comparability, and reliability in revenue recognition practices, resulting in improved financial reporting for stakeholders and investors.

FAQ:

How does Ind AS 115 impact revenue recognition?

Ind AS 115 introduces a five-step model for revenue recognition, which is as described above.

Does this standard apply to all types of revenue-generating contracts?

Yes, this standard applies to revenue-generating contracts with customers, except for contracts that are within the scope of other standards (e.g., leases, insurance contracts).

When did Ind AS 115 become effective?

Ind AS 115 became effective for annual reporting periods beginning on or after April 1, 2018.

How does Ind AS 115 affect industries such as software, construction, and telecommunications?

Ind AS 115 has specific implementation guidance for industries with unique revenue recognition practices, like – software, construction, and telecommunications. It may change how revenue is recognized.

What is the core principle of revenue recognition under Ind AS 115?

The core principle of revenue recognition under Ind AS 115 is that revenue should be recognized when control of goods or services is transferred to the customer, and the amount of revenue can be reliably measured.