Table of Contents

Many businesses rely heavily on leased assets, from factories to fleets of trucks. But until recently, their financial statements often didn’t reflect the true cost of those leases. Ind AS 116 changes all that – shifting what was once ‘off the books’ into a major balance sheet line item. This impacts everything from how banks view those companies to investors comparing competitors’ efficiency.

Ind AS 116, a part of the Indian Accounting Standards (Ind AS), has brought significant changes to lease accounting. Let’s explore how it applies to businesses and its impact.

What is Ind As 116:

Ind AS 116, titled “Leases,” replaces the previous standard, Ind AS 17, and aligns lease accounting practices with global accounting standards. This is issued by the Institute of Chartered Accountants of India (ICAI) which governs the treatment of leases. Its main goal is to ensure that all leases are accounted for on the lessee’s balance sheet, providing a more accurate representation of lease-related transactions.

One significant change is that it treats all leases as finance leases, eliminating the distinction between operating and finance leases. This means lease liabilities and right-of-use assets must be recognized on the lessee’s balance sheet, improving transparency and comparability.

The determination of the lease term has also changed. It includes the non-cancellable period of the lease and may include options to extend or terminate the lease if they are reasonably certain to be exercised.

Ind As 116 applicability:

Ind As 116 applies to all leases, excluding those for non-regenerative resources like minerals and natural gas, biological assets, and licenses of intellectual assets. It covers both lessees and lessors, focusing primarily on the lessee’s perspective. Its impact on businesses is that it requires a careful evaluation of lease contracts and robust systems to track and report lease-related information. The recognition of lease liabilities and right-of-use assets may affect financial ratios and stakeholder decisions.

Transition and Implementation:

Following are considerations and steps that companies need to follow. Here are the key aspects to keep in mind:-

Transition Method:

Companies can choose either a full retrospective approach or a modified retrospective approach during the transition to Ind AS 116. The choice of transition method should be disclosed in the financial statements.

Practical Expedients:

To the transition easy, certain practical expedients are available for lessees. These include the use of hindsight in determining lease terms, excluding initial direct costs for leases expiring within 12 months, and adopting a portfolio approach for leases with similar characteristics. These measures provide some simplification in applying the new standard.

Impact on Financial Systems and Processes:

Implementation of Ind AS 116 requires companies to review and modify their financial systems and processes to capture lease data accurately and calculate right-of-use assets and lease liabilities.

Whether your firm rents office space, manufacturing equipment, or anything in between, there’s a good chance its financials look different due to Ind AS 116. This standard forces lease costs to be treated more like debt on your company’s balance sheet. Understanding why that’s the case, and how to navigate the transition smoothly, is crucial for decision-makers.

Communication with Stakeholders:

Even though your business is thriving, recognizing lease liabilities under Ind AS 116 might cause debt-to-equity ratios to temporarily look worse. This doesn’t change your true financial health, but it DOES make proactive communication with your lenders essential. Explaining that this shift is due to accounting rule changes, NOT increased risk, builds trust.

Companies need to disclose the impact of Ind AS 116 on their financial statements to stakeholders. This includes investors, lenders, and analysts who use financial information for decision-making. Clear and transparent communication helps stakeholders understand the changes in lease accounting and its implications on the company’s financial position and performance.

Ind AS 116 levels the playing field. Previously, two companies leasing identical warehouses for the same price could report wildly different profitability due to how those leases were classified. Now, comparing financials of direct competitors becomes more meaningful, helping you benchmark your firm’s true efficiency better.

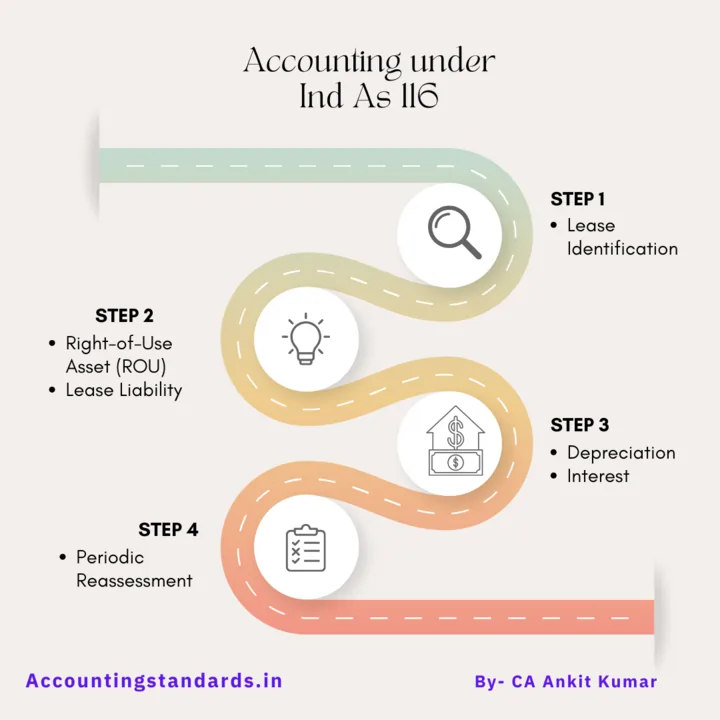

Accounting for leases:

Identify the Lease:

Determine if an arrangement meets the definition of a lease under Ind AS 116. A lease exists when a contract transfers the right to control the use of an identified asset for some time in exchange for consideration.

Classify the Lease:

Classify the lease as either an operating lease or a finance lease. Ind AS 116 eliminates the distinction between operating and finance leases for lessees, except for short-term leases (leases with a lease term of 12 months or less) and leases of low-value assets.

Recognize the Lease Liability:

For each lease, recognize a lease liability on the balance sheet at the present value of the lease payments not yet paid. The lease liability represents the lessee’s obligation to make future lease payments.

Recognize the Right-of-Use (ROU) Asset:

Simultaneously with the lease liability, recognize a corresponding ROU asset on the balance sheet. The ROU asset represents the lessee’s right to use the leased asset during the lease term.

Determine Lease Payments:

Identify and determine the lease payments over the lease term. Lease payments may include fixed payments, variable payments based on an index or rate, and any other lease-related payments specified in the lease agreement.

Allocate Lease Payments:

Allocate the lease payments between the lease liability and the interest expense. The allocation is based on the effective interest method, which recognizes interest expense over the lease term using a constant interest rate.

Recognize Depreciation Expense:

Recognize depreciation expense for the ROU asset over the lease term. Depreciation is typically calculated on a straight-line basis unless there is another systematic basis more representative of the pattern of the asset’s usage.

Recognize Interest Expense:

Recognize interest expense on the lease liability over the lease term. Interest expense is calculated using the effective interest rate determined at the lease commencement date.

Periodic Reassessment:

Periodically reassess the lease term, lease payments, and other factors that may impact the lease liability and ROU asset. Adjustments should be made if there are changes in the lease terms or considerations.

Example scenario:

ABC Manufacturing leases a piece of heavy machinery equipment rather than buying it. Lease terms are:

- Lease Period: 5 years

- Monthly Payments: ₹5,000

- Estimated Useful Life of Equipment: 8 years

- No Option to Purchase the equipment at the lease end

How to Account Under Ind AS 116:

- Right-of-Use Asset:

- Ind AS 116 dictates the creation of a “Right of Use” (ROU) asset on ABC’s balance sheet.

- Initial Value: Calculated as the present value of those lease payments (slightly lowered to reflect interest over time). Let’s assume that’s ₹ 55,000, close to the total they’ll pay over time, but not exact.

- This ROU asset is treated like owned equipment – it is depreciated over its useful life.

- Lease Liability:

- At the start, a liability account mirroring the ROU asset value (₹55,000 in our example) goes on the books.

- Unlike a traditional loan, with each payment, part reduces that liability AND part is expensed as interest cost.

Impact Over Time:

- Year 1: ABC’s income statement likely shows lower profit due to both interest on that liability AND depreciation of the ROU asset.

- Balance Sheet: Equipment they don’t own is on the asset side, mirroring debt from the lease on the liability side. Transparency is higher!

Key Points Simplified:

- Think of it like buying the machine slowly with a loan, even though they won’t own it outright for years.

- Hiding big lease costs off the balance sheet, which older rules allowed, is no longer possible.

Disclosures:

Provide comprehensive disclosures in the financial statements, including information about lease commitments, lease terms, significant judgments and estimates applied, and the impact of leases on financial performance and position.

In conclusion, Ind AS 116 has transformed lease accounting, emphasizing transparency and accuracy in financial reporting. Businesses need to adapt to the changes, ensuring compliance and leveraging the enhanced visibility provided by the standard for lease-related transactions.

FAQ:

How does Ind AS 116 impact lessees?

This requires lessees to recognize most leases on their balance sheets as right-of-use assets with corresponding lease liabilities.

Does Ind AS 116 replace the previous leasing standard, Ind AS 17?

Yes, Ind AS 116 replaces Ind AS 17 and introduces a new approach to lease accounting.

What are the key changes introduced by this standard?

The key changes introduced by this standard include the elimination of operating lease classification for lessees, the requirement to recognize lease assets and liabilities, and a modified approach to expense recognition.

How does this impact lessors?

this standard does not introduce significant changes for lessors, as it primarily focuses on the accounting treatment for lessees.

Are there any exemptions or practical expedients available under this standard?

It provides certain practical expedients, such as the option to not apply the standard to short-term leases (leases with a lease term of 12 months or less) and leases of low-value assets.